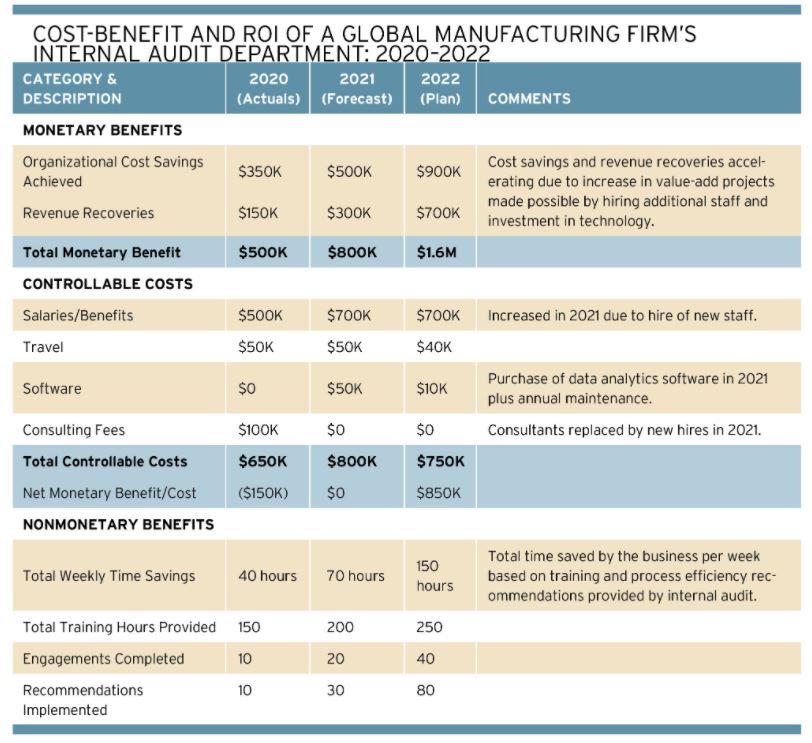

A departmental cost-benefit analysis can help internal audit measure and communicate its value.

Like all departments in an organization, internal audit is an investment expected to yield a meaningful return. But unlike departments where return on investment (ROI) is easily calculated and traceable to the bottom line, internal audit is challenged to assess the inherently qualitative benefits of its work — such as compliance with laws, risk mitigation, process improvements, or providing management with peace of mind via assurance — against the quantitative costs it incurs, such as payroll, travel, software, and training expenses.

While each internal audit function faces different perceptions and unique expectations of value, internal audit teams can use a cost-benefit analysis to measure, drive, and communicate their value, and, ultimately, their ROI.

Read the whole article from here.