Environmental matters are gaining in importance in the eyes of different stakeholders – the investors as well as consumers/customers – as the awareness is rising. The perceived materiality and risks are interlinked, and the risks could jeopardize the social and economic sustainability of the businesses, unless they are properly managed. This development is likely to continue despite the covid-19 related temporary impacts, as there will be more and more people consuming the global natural resources (world population currently 7.8 billion). This article presents some consideration points especially for Board Members but also for other interested parties.

The reporting related to environmental aspects – also known as non-financial reporting – is being unified in Europe. This will lead to better comparability for the investors and others who are interested in the environmental aspects. Additionally, it creates a tool to plan other ways to “internalize the externalities” for example with taxation.

Listening to your customers is key when planning the environmental program and actions – what is the aspiration level and where are the customers ready to pay a higher price for more environmentally friendly products? These aspects would need to be considered also as opportunities in the risk analysis.

Governance is key

From the corporate perspective the environmental aspects are fully related to the industry of the company and the pertinent environmental risks for the business.

To make change happen or have risks properly managed, full ownership – and reliable visibility into the current state – is needed at the top of the organization. The environmental game is ultimately all about the right governance – who decides the targets and actions, and follows the outcomes – and all people working for the company need to cooperate and know what is expected from them. From the personnel perspective active and visible executive sponsorship is needed to make change happen especially if the environmental and economic targets need to be balanced.

Know your risks and opportunities

Everything starts from a risk assessment, which should focus on both current and future risks. The materiality is tested by asking, for example, if there are risks that are jeopardizing our business continuity or what are the main natural resources that are being used in our business.

For “The Emerging Environmental Risk Management Practice” there are questions to guide the management in recognizing the current and future risks, for example with the below questions:

What is the total environmental footprint of our activity for a given period (fiscal year) and geographical area (supply chain)?

How important are the respective natural capital categories (climate: air, water, land, biodiversity) vs the total?

How do we expect the footprint to evolve over time and across locations?

How is the footprint comparing to those of other companies, sectors, countries…?

Are these footprints causing business continuity or other risks now or in the future?

Should we take risk mitigation measures (green investments) and if so, where to concentrate efforts?

How will/is our footprint evolving over time?

Is our footprint evolving according to the plan?

Source: Thomas Verhoeven (European Commission)

The view of the customers also needs to be known and properly added to the risk/opportunity assessment and in the future roadmap.

The game plan and the key performance indicators (KPIs) should be driven by the big digit items – but of course it goes without saying that the smaller acts are important as well when all employers are doing those.

It also needs to be decided how the environmental aspects are embedded and valued in the company. If the bonus system is only about financial targets, the importance of the environmental aspects can get diluted. The green investments are not necessarily generating an explicit return on investment. The environmental targets and risks need to be prioritized and weighted among other targets and risks.

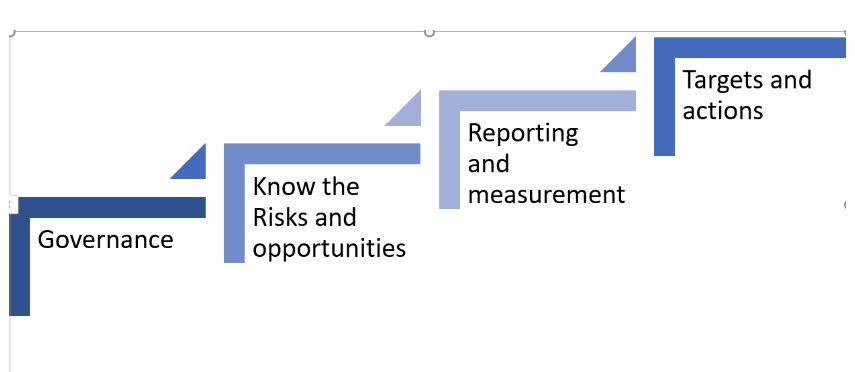

The ladder to create a simple environmental program

Planning and implementing an environmental program is similar to any change program. Governance (and strategy) is the first to be put together with ensuring adequate sponsorship from the executive level.

The second step is to identify the risks and opportunities and the third is creating a reliable measurement or set of KPI’s. You need to know what the thermometer shows. After you know where you stand now, it is possible to proceed to setting targets (long – and short term) and planning the actions.

In addition to the strategy and targets that the Board of Directors is more closely involved with, the top management needs to plan and implement a full change management program with a detailed plan about the responsibilities, actions, communication, training etc. and turn their vision into a step-by-step plan and align their environmental/sustainability objectives with the business goals.

According to McKinsey, 70% of change management efforts fail due to employee resistance and lack of management support. Naturally, an environmental program is not a typical change management program, but it has similar characteristics. If the Board and management do not make the environmental aspects important for the employees, at least the more ambitious targets requiring the extra mile will surely not be met.

Moving target – need to Follow up and re-calibrate the KPI’s/ targets regularly

As we are living in a constantly changing world, there is a need to have a regular update on the environmental risks – presumably at least on an annual basis – highly also depending on the business of the company.

In addition, the natural capital accounting (or e-GAAP) is developing, and close eye needs to be kept on that including the materiality, scope and relevant values.

Kristiina Lagerstedt

CAE at Kemira, Board Member and AC chair

Avaa koko näytössä.